WFG TRID* READINESS | Executive Summary

*TILA-RESPA Integrated Disclosures – Oct 3, 2015

Donald A. O’Neill, EVP/Chief Compliance Officer, WFG National Title Insurance Co. | doneill@wfgnationaltitle.com

In July the Consumer Financial Protection Bureau (CFPB) confirmed that the effective date of the Bureau’s “know before you owe” TILA-RESPA Integrated Discolsure (TRID) RULE be extended to Saturday Octobor 3, 2015

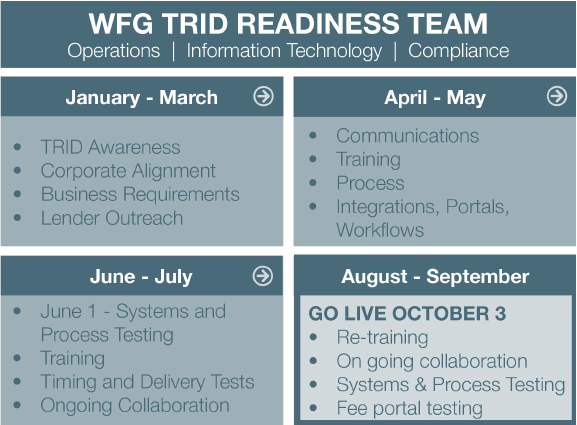

Even with a 60 day extension, WFG remains committed and focused in our TRIP preperation. At WFG we continue to be focused on systems integrations, employee training, lender outreach and Realtor communication efforts.

Top 5 Things to KNOW about TRID

- Know how information on the Loan Estimate (LE) and Closing Disclosure (CD) will be transferred between lender and settlement agent – will they be transmitted through system integrations, electronically e.g. email or manually?

- Understanding Tolerance categories: “Zero tolerance” examples would include Origination charges, Transfer taxes, Fees paid to affiliates of the creditor and fees paid to the creditor’s required settlement service providers. “10% Tolerance” examples would be Recording fees and fees for a required service to a third party provider that the consumer selected off the list provided by the creditor.

- Know that your transactions will also be governed by State regulations and forms.

- To improve communications and avoid possible delays – lenders and settlement agents should consider having a “pre-call” with the consumer before the CD goes out and prior to consummation.

- Review the standard purchase and sale contract used in your area and know who is designated to pay the owner’s title insurance premium and how the simultaneous owner’s/lender’s title premiums will be calculated.

Between now and October 3 we will continue to be focused on overall TRID readiness and training. We encourage you to SHARE YOUR PLANS WITH US for TRID collaboration as we prepare for the new effect date – October 3, 2015.

Share your plans with us… so that we can work together in creating a collaborative closing solution tailored for you.

- What is your Loan Origination System (LOS) and Document preparation system?

- How will you obtain accurate title premiums and settlement fees for the Loan Estimate?

- How will you deliver a copy of the Loan Estimate to WFG?

- Will you prepare the Closing Disclosure? If so, how will WFG collaborate with you?

- Will you be delivering the Closing Disclosure to the Borrower? If so, how will you deliver a copy to WFG?

Share your plans—Stay connected—Sign up for updates by sending an email to: WFGTRIDreadiness@wfgnationaltitle.com

Please share with us the names of your warehouse and wholesale lenders. WFG wants to be on your SSPL as a listed approved vendor.